The most basic budget apps typically connect with your financial accounts, track spending and categorize expenses and so you lot tin can see where your money is going. But many apps do much more than that.

The budget apps beneath are oversupply-pleasers because of their features. At the time of this writing, each has at to the lowest degree iv.5 stars (out of 5) in the iOS App Store or on Google Play, also as at least 1,000 reviews. ( Jump to the methodology .)

The all-time budget apps

Mint, for merely almost everything

Why we recommend information technology: Let's start with Mint'southward very loftier ratings in both the App Shop and Google Play. (It also has, by far, more reviews than any other app we reviewed.) It'due south free and syncs many kinds of accounts: checking and savings, credit cards, loans, investments and bills.

Every bit far as the bodily budgeting, Mint automatically puts your spending into budget categories. Y'all can personalize these categories, which are unlimited. You fix limits for these categories, and Mint lets you know if you lot're approaching those limits.

Too those budgeting features, Mint may help users pay down debt, relieve more than money and rails goals. The app also shows users their credit score and net worth. Bonus: Mint provides tons of support for using the app, including a detailed FAQ and a list of "known issues."

Why you may want to recall twice: Mint is impressive in many ways, including the fact that information technology tracks but about everything on your behalf. Simply that may not be ideal if you're looking to be more than actively hands-on in your budgeting. If you're searching for an app in which you plan ahead for your money, rather than track it after the fact, other apps on our list may work amend for you.

Cost: Complimentary

Apple store rating: 4.8

Google Play rating: iv.5

Annotation that all ratings were current every bit of Dec. xv, 2021.

Goodbudget, for hands-on envelope budgeting

Why nosotros recommend it: Goodbudget is more about planning for your finances than tracking previous transactions. This app is based on the envelope budgeting system , in which you portion out your monthly income toward specific spending categories (called envelopes).

This app doesn't connect your banking company accounts. You manually add account balances (that yous can pull from your bank's website), besides as cash amounts, debts and income. Then you assign money toward envelopes.

Yous can admission the app from your telephone and the web. You'll also discover many helpful manufactures and videos that help yous use the app.

Goodbudget offers a free version that allows one business relationship, two devices and limited envelopes. Its paid version, Goodbudget Plus, allows unlimited envelopes and accounts, upward to five devices and other perks.

Why you may want to retrieve twice: Because yous can't sync financial accounts, yous must enter every expense. If you're not up for that work, the app probably won't be effective.

Price: Goodbudget is free. Goodbudget Plus is $7 per calendar month or $60 per yr.

Apple shop rating: 4.vii

Google Play rating: 4.5

Nerdy tip: Want to attempt envelope budgeting and sync your accounts? Bank check out Mvelopes. Information technology didn't quite brand our listing but follows the same budget system and allows yous to link bank accounts.

YNAB, for hands-on zero-based budgeting

Why nosotros recommend it: YNAB is designed so that users programme ahead for their fiscal decisions, rather than rail past transactions. This app follows the zippo-based budgeting organisation, which has yous brand a programme for every dollar y'all earn.

Every bit presently as you get paid, you lot tell YNAB how much of your income should become toward diverse categories, including expenses, goals and savings. The idea is that you become more intentional with your money when yous're prompted to actively determine what to exercise with it.

With all this decision making, YNAB is nigh as easily-on as you can go. To help users expedition upward that learning curve, YNAB's website offers many educational resources describing exactly how to budget and use the app.

YNAB allows you to link your checking and savings accounts, likewise as credit cards and loans. The app works on the phone, desktop, iPad, Apple Watch and Alexa.

Why you may want to recollect twice: You have to be committed to go on upwardly with YNAB. Past blueprint, it works all-time for users who want to become hands-on while planning for their coin. Also, compared to the other apps that made our list, its price is high, and its Google Play ratings are low.

Price: Pay either $14.99 per month or $98.99 per yr, although yous can try information technology out in a gratis 34-day trial. College students tin utilise YNAB for free for a yr.

Apple store rating: four.viii

Google Play rating: 3.2

EveryDollar, for simpler zero-based budgeting

Why nosotros recommend information technology: This apps offers a zero-based budgeting framework that'due south simpler (and maybe easier to manage) than YNAB.

Get-go, an explanation of the names: EveryDollar is a free budgeting app. But, to get the app'southward extra features, you must go a Ramsey+ fellow member. In improver to a beefed-upwards version of EveryDollar, a Ramsey+ membership includes other, off-app features, such as audiobooks and courses.

The free version is simple, in function because you don't sync accounts. Yous manually enter incoming and outgoing money throughout the month. You also categorize line items in your budget and fix reminders for beak payments.

If you sign up for Ramsey+, you can connect your bank accounts and so information technology'due south simpler to track transactions. You can also rails debts, see reports on how you lot spent your money and impress your transaction history.

Why yous may desire to remember twice: The gratis version of EveryDollar is pretty blank-bones, and the Ramsey+ membership is more expensive than whatever app on our list. Too, the app's website offers few resource to help you empathize how to use the app before signing up for a trial.

Cost: The basic version of EveryDollar is gratis. To access more features, you must join Ramsey+, which you can try for free for 14 days. After the trial, you can pay $59.99 for three months, $99.99 for six months or $129.99 for 12 months.

Apple shop rating: 4.8

Google Play rating: 4.two

Personal Capital letter, for tracking wealth and spending

Why we recommend it: Personal Uppercase is primarily an investment tool, simply its free app includes features helpful for budgeters looking to rail their spending.

You can connect and monitor checking, savings and credit card accounts, also as IRAs, 401(thou)s, mortgages and loans. The app provides a spending snapshot past listing recent transactions by category. You can customize those categories and see the percentage of full monthly spending each category represents.

Personal Uppercase besides serves upwardly a net worth tracker and portfolio breakdown. The app can be accessed through both phone and desktop.

Why you may desire to think twice: If your goal is to plan out your spending and saving, yous may want to go another route. This app'south budgeting features helped it brand the list, but its investment tools are what make it unique. Other apps have more in-the-weeds budgeting capabilities.

Price: Complimentary

Apple tree store rating: 4.7

Google Play rating: iv.4

Nerdy tip: Some other app worth checking out is Copilot (iOS only). That app tracks investments, in addition to tracking and categorizing expenses.

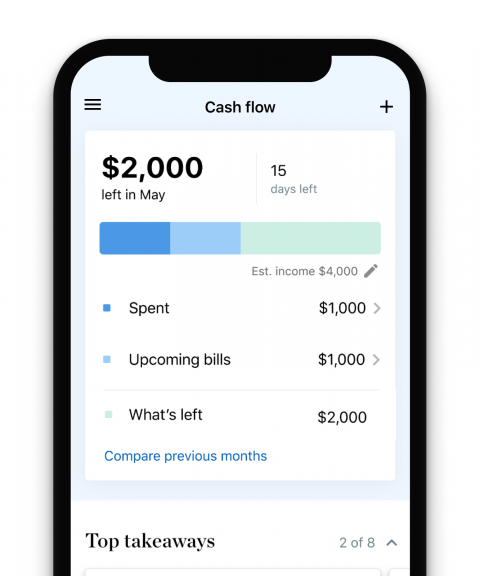

PocketGuard, for a simplified budgeting snapshot

Why we recommend it: PocketGuard's catalogue of features isn't the most robust on our list, just that's office of why we like it. The app is big on simplifying.

Yous tin connect your bank accounts, credit cards, loans and investments and rails bills. With that intel, the app shows how much you accept left to spend after setting aside funds for necessities, bills and goals.

PocketGuard also tracks your net worth and gives y'all the option to not link your accounts and instead track your finances manually. The paid version, PocketGuard Plus, offers a debt payoff plan, the option to consign your transactions and other features.

Why yous may want to think twice: This app does a lot of work for you. That's proficient for a by and large easily-off experience, just less so if you desire to plan for your money. Also, a heads upwards for Android users: PocketGuard also has one of the lowest Google Play scores in our list of best upkeep apps.

Cost: Basic PocketGuard is free. PocketGuard Plus is $7.99 per calendar month, $79.99 per year or $99.99 for a one-fourth dimension lifetime buy.

Apple tree store rating: 4.vii

Google Play rating: 3.half dozen

Honeydue, for budgeting with a partner

Why we recommend it: Honeydue is designed and so yous and your partner can view both your financial pictures in one app. Both partners can sync bank accounts, credit cards, loans and investments. (Although yous tin choose how much you share with your significant other.)

The gratuitous budget app automatically categorizes expenses, merely you're also able to create custom categories. Together, you tin set upwardly monthly limits on each of these categories, and Honeydue volition alert you when yous or your partner is nearing them.

Honeydue also sends reminders for upcoming bills and lets you chat and transport emojis.

Why you may desire to think twice: Like a few other apps on our list, Honeydue leans more toward reflecting and learning about past transactions, rather than planning ahead for expenses.

Price: Gratis

Apple tree shop rating: 4.5

Google Play rating: four.0

Nerdy tip: Zeta Money Manager and Firstly (previously Honeyfi) are also designed for multiple people to see their finances in 1 app.

Fudget, for budgeting without syncing accounts

Why we recommend it: Consider Fudget if yous'd rather not sync financial accounts and would prefer a straightforward, calculator-esque interface over fancy features.

In Fudget'south ultra-simple design, you make lists of incoming and outgoing money and runway your balances. There aren't even any upkeep categories. The Pro business relationship allows you to too export your upkeep, forth with other extras.

Fudget, which is new to our all-time budget apps list, has a Google Play rating that's higher than any of the other apps nosotros reviewed and an App Store rating that ties for the highest score with a few other picks.

Why you may want to recall twice: This app is likely also simple for y'all if you'd prefer categorization of expenses, insights or just about annihilation else besides the basics. And if you don't accept information technology in you to log every expense, it'south likely best to wait elsewhere. We also didn't observe much in the way of user guides.

Cost: Complimentary for Fudget; $3.99 i-time buy to upgrade to Fudget Pro.

Apple store rating: 4.8

Google Play rating: 4.6

Budgeting resource from NerdWallet

NerdWallet has a free app that lets you lot runway your cash, meet your net worth and debt, and track your credit score. We chose not to include ourselves in the list higher up in order to present an unbiased view.

Earlier yous build a budget

NerdWallet breaks downwardly your spending and shows you ways to save.

We as well offer non-app options you can endeavor:

-

Explore online budget templates for a quick check of your finances.

-

Estimate how to divide your monthly income using the 50/30/20 rule .

Methodology to place the all-time budget apps

To come upwards with the lists above, we offset reviewed 18 money apps. Nosotros appreciated apps that allowed users to practise the following:

-

Sync several types of financial accounts (and opt out of syncing).

-

Program ahead for fiscal decisions versus just tracking past transactions.

-

See their expenses categorized and create custom categories.

-

Track bills and receive alerts for upcoming due dates.

-

Share fiscal information with partners.

-

Access the app via both the mobile app and desktop.

We also gave unofficial bonus points for squeamish-to-have features, such as showing credit score and net worth, too as tracking investments. We noted apps that were free or relatively inexpensive.

The experiences of real users matter, too. And then we read reviews of the apps in the iOS App Store and Google Play, noting complaints and kudos. We only included apps that received at least iv.5 stars (out of 5) in the iOS App Store or on Google Play, likewise every bit at least ane,000 reviews. Those ratings were pulled on Dec. 15, 2021.

DOWNLOAD HERE

Posted by: blackshireagand1991.blogspot.com